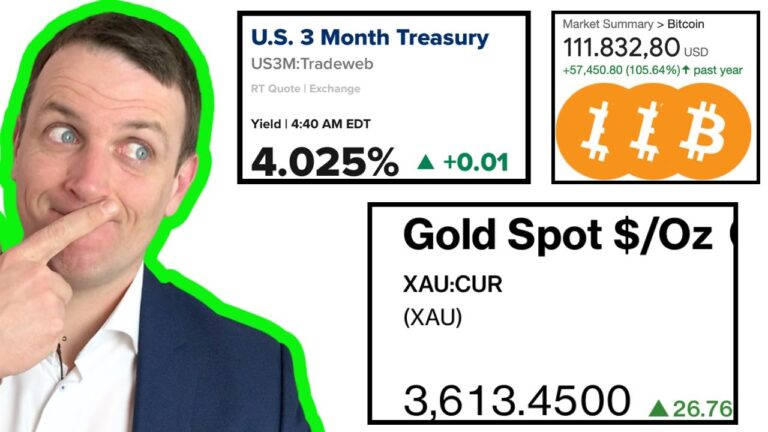

Predicting a crash is impossible, but is it smart to go into gold, bitcoin or other?

If you are a sophisticated investor looking for in depth, independent stock analyses, a strategic value investing portfolio approach, here is my STOCK MARKET RESEARCH PLATFORM (business and sector risk and reward analysis, my portfolios):

STOCK MARKET RESEARCH PLATFORM:

Want to Reinforce Your Value Investing Mindset And Improve Your Investing Skills: Sign up for the FREE Value Investing Course – a comprehensive guide to investing discussing all that matters (from mind to accounting):

I am also a book author:

Modern Value Investing book:

Key videos to watch:

INTRINSIC VALUE CALCULATION

QUADRANT UPDATE (stocks to buy)

Peter Lynch stock categories

When investing, your capital is at risk. The link in this description to Interactive Brokers is an affiliate link. This means I may earn a commission if you click them, at no cost to you. These links help support me and the channel, but they are not part of any sponsorship. I am only sharing my own experience and the views I express are mine alone – I’m not a financial advisor and do not make investment recommendations or give investment advice. You should always do your own research and due diligence before investing. None of the information contained herein constitutes a recommendation, offer, promotion, or solicitation of an offer to buy, sell or hold any security, financial product or instrument or to engage in any specific investment activity.

I often get asked about brokers, here is a low fee broker, an international one that allows you to buy on global markets, and also offers complex solutions like options for when your investing skills grow. For now, it is one of the best solutions I have found for global investors, also based on your comments and inputs:

0:00 Stock Market Crash

2:20 Cash?

4:06 Gold/Bitcoin

5:16 Everything Expensive?

source

49 Comments

Oct 2, got out of gold as it gets close $4k. August to September was a good run.

i like this "fundemental is the best return to look at , not gold / cash/ ,,,etc":

I used to be a big fan of Sven. Unfortunately he spends half of his time talking about crashes.

Considering fiat money as ‘cash’ is going to look real stupid real soon. If everything is going up, what is going down? Is this likely to continue? Over the medium to long term this is inevitable. I get not having an opinion etc and focus on fundamentals but at some point and for some things there is value in doing some research.

Forget the negative comments Sven, your perspective is invaluable

Gold yes. 1000X in 50 years isn't bad.

Bitcoin is well as Munger said, "rat poison".

please do review of: AMCOR PLC

very interesting viewpoint Sven, when possible kindly do an update on Gold miners and Copper miners. Gold / Cu ratio is at 2008/09 levels!

I am 70 and have been retired for the last 5 years. Over the last 5 years I have done well in the market and now own mostly T-bill ETF's collecting around a 4% return. I have enough money to last the rest of my life and I can live on a 4% return along with a small indexed pension and goverment payments of CPP and OAS. I agree with you that the market is in bubble territority but it could also be 1998 and it could go up for another 2 years. If it does correct I will invest, if not I am fine to watch from the sidelines.

I’ve read several comments on Reddit about your 29 year horizon portfolio closure on 2022 just a few years upon conception. For the sake of transparency, could you elaborate on it?

Just buy quality scotch whisky. If the crash comes, drink it

Made 8% in Gold ETF is a couple of months. Clearly sign of an upcoming crash?

Great video Sven and nice to see you back in action. What do you think about Constellation Brands (STZ) stock ? The stock is cheaper now compared to when Berkshire and Buffett's bought their positions. Would be great if you do stock analysis 🙂

I know the Future , the S&P 500 will hit 7500 by year end, the fundamentals always come out in the charts first

Gold is money. The rest is credit

So if im sitting on 200k of cash, i know what i want to buy just waiting for the right prices to make my moves. What would you do if you were me ? Im unsure of holding it in cash

Oh ….look at what happened today….in France….! I think they are listening to you, Sven! ;))

Your research platform can be more attractive if you make monthly instalments option rather than onetime payments!

Gold is entering all-time purchasing power against other assets.

55 barrels of oil per ounce is huge. 100 ounces to buy a median priced house is as high as its ever gotten, etc…

Could go higher, but at $4000, history says its at all-time highs in value.

If the market crashes as many times as Sven predicted, SP500 would be less than 100 right now 😂

S&P goes to 2,000 by March 2029

thanks Sven if you want to know the future, watch The Simpsons

Aker BP isn't available on mainstream platforms here in the UK and if you buy Equinox you have to pay 2 lots of dividend withholding tax, one from Norway, the other from the US or Germany (depending which exchange you buy it). So not much use recommending it for many of us.

Keep in mind Warren is not holding cash under the pillow, he has it in short and possibly now long term govt bonds, making 3.7-4.7% in cash flow. These are liquid, because you can always borrow against them. Also long term ones should start falling sooner or later, so he will sell for a premium. Let say he has 4.7% 30 year, if it falls to 3.7% over a year or two, thats like 20% bond price increase/premium. When bond interest drops, bond price increases.

When it came to gold, you said, "for something that does nothing", this return is good. Do your dollar bills do anything for you? Gold is a medium of exchange and it solves a very important problem. It cannot be diluted when governments monetizes its debt (US interest bearing debt =6X its income? Annual deficit: 40% of income? Unfunded liabilities,e.g., social security: over 100 trillion?). If you know these numbers and are not scared, your skull is too thick. Another thing that is happening in parrallel: Gold drops less when demand for dollar as a reserve currency drops (given geopolitics, US weponization of its currency, and depreciating value): other nations have been reducing their reserve of dollar. Oh: the ignorance and over-confidence of your tone. I usually do not engage with such self-rightous tone, but I used to respect you once. Sorry, you are an idiot and one who is closed to understanding it. Wait for gold to go to 10K and continue your ignorance.

Summary: "cash, gold; we don't know". No recommended stocks. Valuations are high. Nothing to see here. Pass the beer nuts.

Predicting a crash is trash

Can you cover AMT?

Here's a prediction: dollar devaluation!!

Sell short duration 10-15 delta cash secured puts on something like QQQ, avoiding assignment while collecting both interest and premium? I would think this would achieve keeping our money liquid for opportunities while providing a net credit + interest that would likely annualize a better return than bonds, and as good if not better many equity options. Pitfalls? Thoughts?

Hi Sven, how do you feel about Linde or Air Liquide?

Buffet is not only waiting a crash. He has also said that the market is too expensive and he can't find investments with margin of safety.

Hi Sven…Can you share your thoughts/or make a video on the UK market …especially dividend shares with 8-9% yields for companies…legal &general or BATS or Taylorwimpey…thank you

The problem for me, as a U.K. investor, is that GBP looks a lot more likely to crash than US equities, hence I’m 20% gold/ bitcoin.

Sven what’s your opinion on Canadian O&G companies?

sold 30% of my stocks cause I wanted some more cash just in case.

Heiniken is cheap. 13 p/e on good brands growth + dividend + buyback seems like a no brainer

Missed Sven, welcome back

I don't think Bitcoin is a risk-off asset yet, whereas gold is. Long term though that may change.

People buy hard asset like a house but essentially it is sitting there not doing much. It needs repair and there is always a problem of tenant squatting. Post Tax returns are bad if the house is not in prime location.

It’s hard to not ignore Buffett or at least take notice. Certainly it got me to hold back some dry powder…sitting in short bonds now locked in getting 4%.

BRK is on my market crash shopping list. It’s nice to have gotten a bit of a correction when Buffett announced his retirement. Can the new top dog not achieve strong results… Guess time will tell, but first we need the recession so I can buy it at a decent price.

You are 100% my favorite value investor !!!

Sven I can predict the future send me all your money and I’ll predict you go broke. I always enjoy your videos.

The writers of the Simpsons only know the future

Oh the poor professor

🗽 I'm holding ~25% in Cash (shor-term bonds). I protect the cash with gold against inflation.

.

I hold gold and bitcoin not to avoid an equites crash but to protect against long term monetary debasement

"Sven is predicting a crash" "Buffet is waiting for the crash" why everybody just think in binary terms 😂, there's lots of greys between black and white

If central banks keep printing and government keep massive deficit spending = higher and higher stock prices. It also means hard assets will do well too.