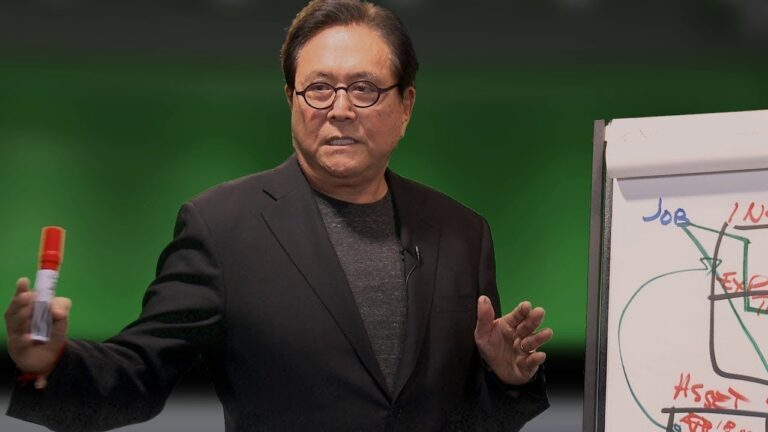

Assets and liabilities serve as the central focus of this episode of Millennial Money featuring Robert Kiyosaki. Robert dismantles a pervasive misconception—that your house is an asset. This idea is debunked to underscore the importance of understanding the true nature of assets and liabilities in one’s financial journey.

Robert goes on to propose that people themselves can be assets or liabilities. The discussion extends to the financial responsibilities associated with caring for family members. This aspect brings forth the idea that while family can be a source of emotional support, they can also be financial obligations.

Examples of human liabilities, with a focus on financial commitments such as alimony and child support. This serves as a stark reminder of the financial responsibilities that individuals may have to shoulder in various life situations.

This episode not only clarifies the distinction between assets and liabilities but also underscores the importance of financial literacy, cash flow management, and the multifaceted nature of financial responsibilities in the context of family and personal finance.

#robertkiyosaki #richdadpoordad #millennialmoney

Facebook: @RobertKiyosaki

https://www.facebook.com/RobertKiyosaki/

Twitter: @TheRealKiyosaki

https://twitter.com/theRealKiyosaki

Instagram: @TheRealKiyosaki

https://www.instagram.com/therealkiyosaki/

source

43 Comments

Robert kiyosaki- “Don’t buy a car!!”

I had one question. When rich dad is saying that the cashflow from a real estate which he purchased is positive, does he mean that the the cashflow is calculated after all the expenses related to the real estate like loan to be paid per month to the bank, etc. is removed and the final cashflow is put forth before us?

Any one 19 Sep 2025

The 20 dollar Trick

詐欺師 アメリカの掲示板では皆さんそう言ってた。

神のように崇めてるのはアホな日本国民だけ。

But did not show how to increase assets to take care of the liabilities.

Evil all the time…

Well done.

Always the best advices!

This guy is jealous of PhDs, he couldn't have one despite being a rich person. 😀

In real estate investment

Thanks for your response to your teaching skills in financial development

🎉🎉🎉

chubkas daisy dukes

walter mangussons taxed jukes

haos rain judge rebukes

Any guy from 2027?

The only thing I think about is that if I create a life of debt, when I eventually die, my kids are most likely going to be left dealing with this. I know I won't be here, but still.

When this guy dies, I'm sure all of his properties and assets are going to his kids. But, can they sell everything off to pay off his 1.5 billion dollar debt?

$VDOGE blends cultural pride with crypto energy, creating something truly unique. The community’s drive is strong—this project’s just getting started.

Hello anyone here 2025??

How can i buy his books with his signature !? I'm here in kuwait ?

he is 100% spot on. but he needs to explain further in to it because many will get confused. he is talking about tax brackets. emoloyee and self emoloyed have the highest tax liability ( scalable) with 30-45% and almost none tax deductions and credits . now when you join the corporate tax bracket of 20% fixed ( S,C corp or llc stractured with corporate taxation) then you can offset many things tax credits are all over the place and then the game starts with properties cashflowing brrrr strategy. were you can aventually off set 100% of your properties ARV value( after repair value ) from your corporate tax liability paying almost none taxes. i hope god you all and your families 🤲

Where are we gonna live? Duh! One gotta have A house!!

Being financially literate is a must.

The mindset of a worker is different from,

The mindset of an entrepreneur, different from,

The mindset of a businessman, different from,

The mindset of an investor.

Understanding All of these thoughts is very necessary.

All of this initially requires you to increase the capacity of your thought container, from a container that is only the size of a 250 ml water glass to a water container with a capacity of 1000 liters, so that what goes into your thought container does not overflow in vain.

Think Big, don't Think Small !

Before Playing, do your homework first.

How to understand the flow of cash flow,

How to distinguish between good and bad expenses,

How to know the market's desires,

How to sell and buy, Goods or a Business,

How to turn Expenses into Incomes,

that's what needs to be considered and understood.

Read and study Robert.T.Kiyosaki's books, these books are translated into many languages so it is easier for you to understand them, even your children can understand them more easily.

Rich Dad Company also sells financial games, which teach your child to know about finance from an early age.

Overview: Robert Toru Kiyosaki is an American businessman and author, known for the Rich Dad Poor Dad series of personal finance books.

He founded the Rich Dad Company, which provides personal finance and business education through books and videos, and Rich Global LLC, which filed for bankruptcy in 2012.

Source: Wikipedia

Please Hindi language ❤❤❤❤❤❤

is she single?

This video is only for americans

Nice 🎉🎉🎉 1:01

Only to me this makes totally no sense? Cmon…

Very profound it's aligning to Conceptual Framework, IAS 7 & 40,

So the answer is rent your house? I learnt nothing else. How to convert liability into asset?

Wow 😊

Wow. This is such a great video!

What the hell is this comment 2025 bc jab mann tab dekho

❤

I should be the ONE singing there.

The one and only

His advices are pure gold ❤

$SOH up 3.75%. Lets go

I’ll change my life, starting now!!

I hear people say stuff about like oh college is so expensive for my kids. Man… My parents wont pay for me to go to college. Im an excellent student, did well in my classes. Struggled a little getting through senior year since I switched schools. They just wont pay. Honestly its really frustrating becuase nobody told me that If I wanted to go to school it was coming out of my pocket. I would have been saving up for it. My parents just dont work hard and they are so annoying. They just let me down bruh because nobody told me that If i wanted to go to college I had to pay. Plus my younger brother goes to a private high school that is 30,000 dollars a year. Thye are paying full price. They wont pay for me to go to community college or split the cost though. Screwy parents.

Bring something like this if you can start from Zero once.

Some good financial principles here. However, a Child of God should never be labeled a liability. While they consume, the preciousness of who they uniquely are as God's Child is priceless. Slapping overgeneralized labels on people is not accurate either. It kind of feels like an excessive focus on money can desensitize you into forgetting what matters most.

This is so fake and bullcrappy.

Tryed to change a liability into an asset by farting in my couch..

Didnt work

Don't get a job cause you'll waste money on taxes, don't buy a place to live because you should rent it out, don't get kids, if you do: don't let your kids get old. Don't exist cause you're a liability. Did I understand it correct?😅 I'm probably low on IQ for not understanding how he said I should control cash-flow while having a life. F. ex. if you buy an apartment to rent out. Where should you actually live?

ABSOLUTE CON ARTIST, HE GETS RICH BY SELLING BOOKS AND SEMINARS, HE'S POOR DAD IS POOR COZ 4 CHILDREN DEPENDENT AND HAVING SON LIKE HIM……HE'S ABSOLUTE LIAR, DO UR RESEARCH CAREFULLY ESPECIALLY TO THIS ROBERT