3M Company MMM reported better-than-expected fourth-quarter 2024 results and initiated 2025 guidance on Tuesday.

The company reported net sales of $6.01 billion, a slight increase of 0.13% year-over-year. Adjusted net sales totaled $5.808 billion, up 2.2% YoY, beating the consensus of $5.781 billion. Adjusted EPS was $1.68, down 2% YoY, beating the consensus of $1.66.

3M said it anticipates adjusted total sales growth of 0.5% to 1.5%, driven by adjusted organic sales growth of 2% to 3%. The company projects adjusted EPS in the range of $7.60 to $7.90 versus consensus of $7.78.

3M shares gained 4.2% to close at $146.89 on Tuesday.

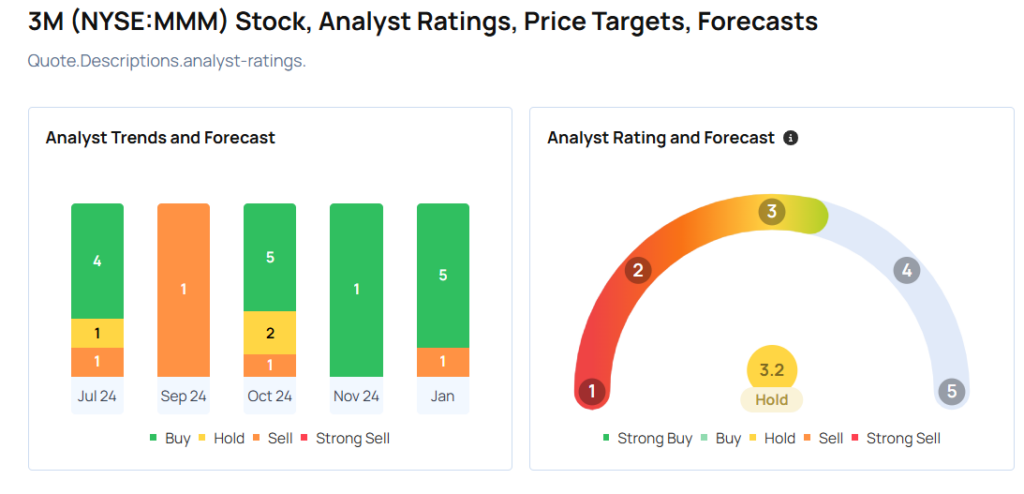

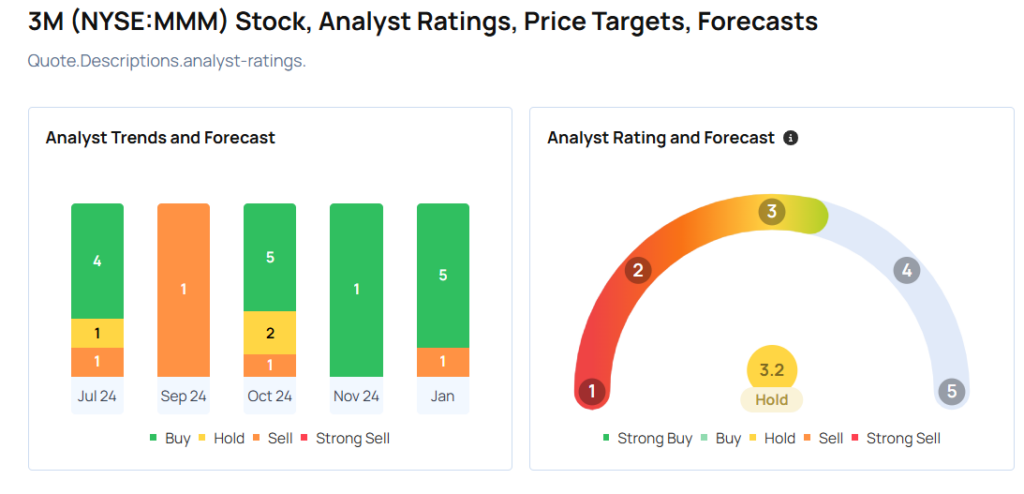

These analysts made changes to their price targets on 3M following earnings announcement.

- Wells Fargo analyst Joe O’Dea upgraded the rating for 3M from Equal-Weight to Overweight and raised the price target from $140 to $170.

- JP Morgan analyst Stephen Tusa maintained 3M with an Overweight rating and raised the price target from $162 to $165.

- Barclays analyst Julian Mitchell maintained the stock with an Overweight rating and boosted the price target from $161 to $165.

Considering buying MMM stock? Here’s what analysts think:

Read This Next:

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.